The EITC Coalition

Free Tax Assistance

The San Diego County EITC Coalition

As part of our efforts to enhance economic mobility, United Way of San Diego County (UWSD) leads the San Diego County Earned Income Tax Credit (EITC) Coalition, comprised of over 48 community partner organizations dedicated to assisting low- to moderate-income individuals and families file their taxes for free. In addition to free tax filing assistance, the Coalition helps hard-working families claim state and federal Earned Income Tax Credits (EITC) that can help lessen financial strain.

47,581

federal and state returns filed.

$34.3 million+

in federal and state refunds were brought back to San Diego County.

$8.7 million

saved in tax preparation fees, an average of $350 per return.

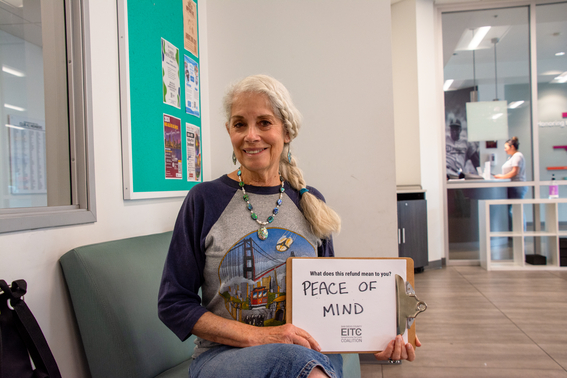

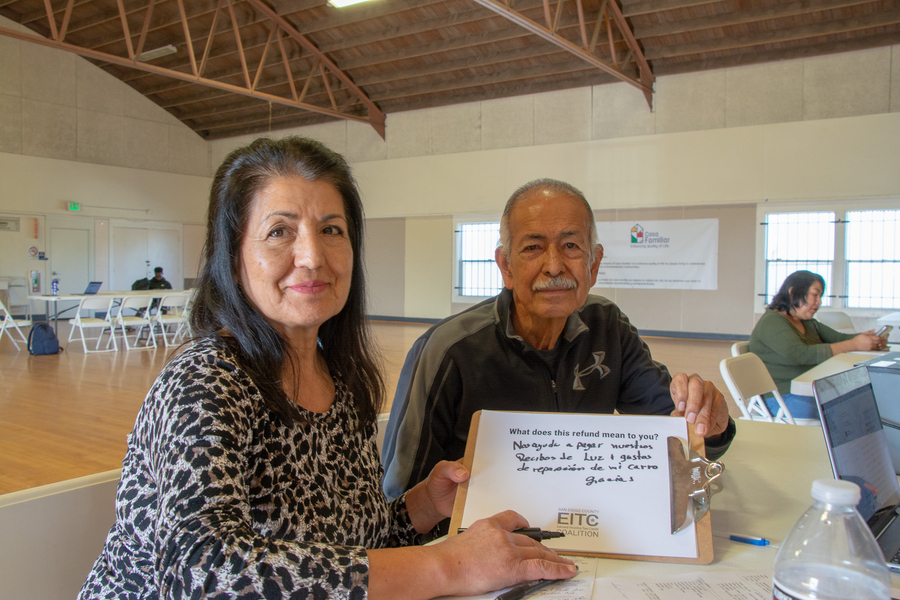

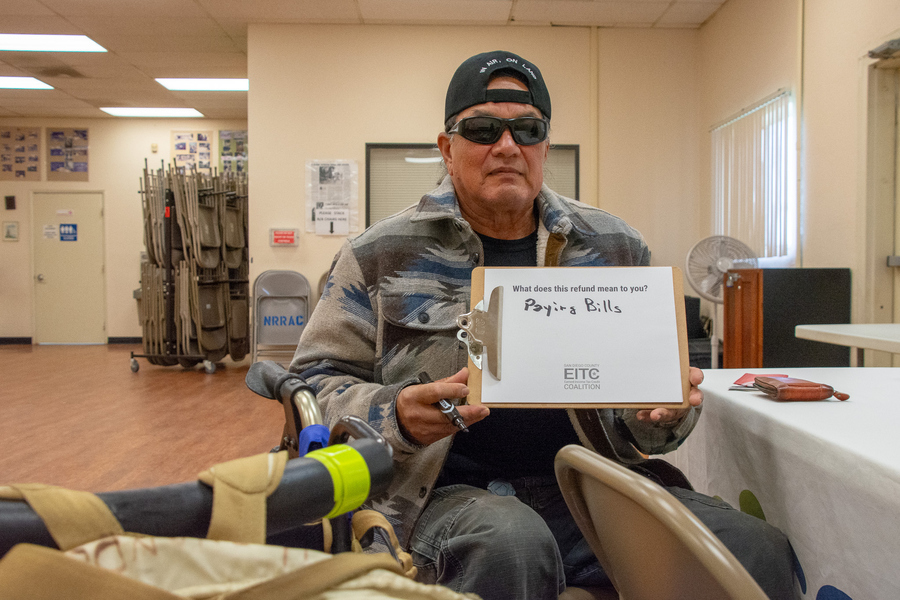

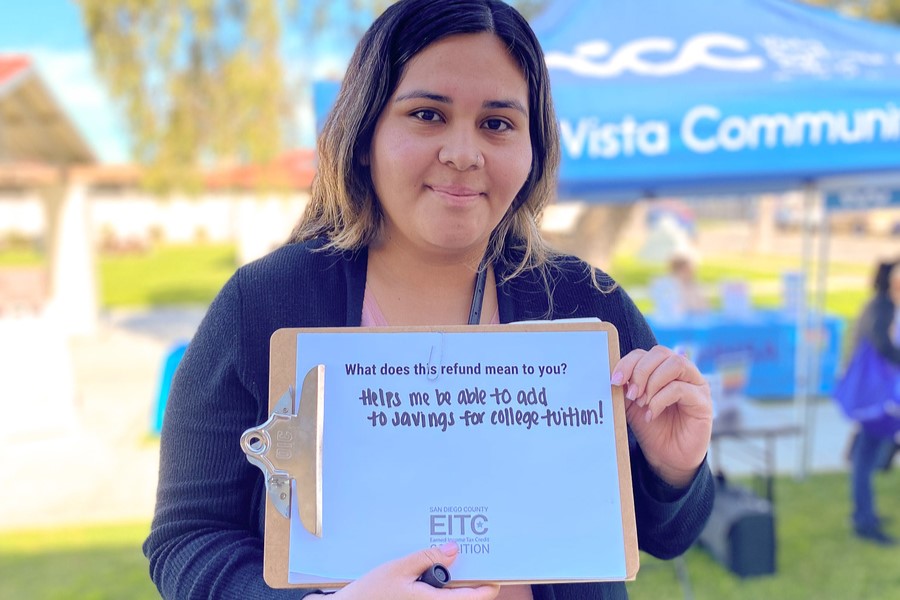

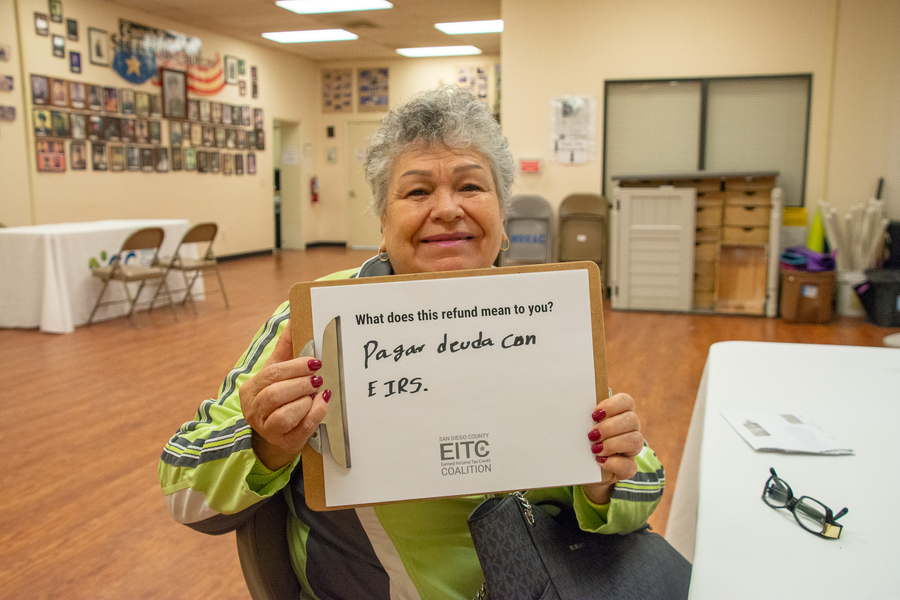

Putting Money Back into the Hands of San Diegans

For over 24 years, the San Diego County EITC Coalition has provided free tax filing assistance to qualifying San Diego County residents at zero cost. The Coalition helps low- to moderate-income individuals and families maximize their tax refunds and access crucial tax credits, enabling them to put more money in their pockets for basic needs, such as food, rent and mortgage, utilities, transportation, and other unexpected costs. In fact, EITC is considered one of the largest and most powerful economic empowerment programs in the nation, and decades of research show that the EITC encourages work, improves families’ well-being, and boosts school achievement for children.

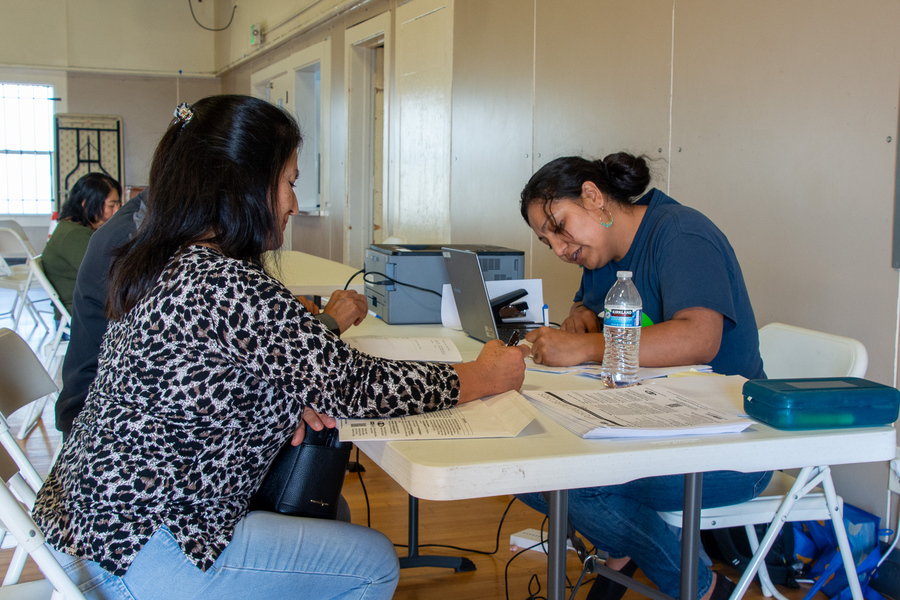

A Collaborative Approach to Supporting Our Community

Through the Coalition’s work, we provide a financial boost to those facing hardship, paving the way for more financial stability for all San Diegans. Community organizations in the San Diego County EITC Coalition implement a coordinated and cohesive approach to providing free tax preparation services to the community. Due to this coordinated approach, clients receive the same information no matter where they live in the county and can access services by calling 2-1-1 or by going to MyFreeTaxes.org.

“Thanks to the free tax preparation service provided by the Coalition, I saved hundreds of dollars in filing fees and was able to get money back that will help me work toward my dream of getting my teaching degree and becoming an educator.”

- Heather

“My experience was really wonderful. My tax preparer was very personable, helpful with my mobility limitations, and asked a lot of questions. It’s important for people to realize that older adults have physical limitations. She was even able to pull up my previous years’ taxes so I didn’t have to go home. And the best part – I’m getting money back.”

- Mary Jo

“This refund means more money towards my savings and emergency fund.”

- Tara

“I am very thankful for the IRS volunteers as this refund will help me stay up to date on all of my bills.”

- Christopher

“This refund means a lot to me. I will be able to pay for part of my college tuition. It will help me out a lot.”

- Antonio

“Today was my first time filing my taxes and I was super satisfied with the service and results. Carmen was really helpful and friendly. She hooked me up with additional resources that I’m looking forward to following through with. With my tax return money, it will help me purchase my first car and I can save what’s left over for an apartment down payment and build up from there. I enjoyed my experience here and will most definitely come back next year.”

- Nevaeh

Could you or someone you know benefit from these services?

Call 2-1-1 or visit MyFreeTaxes.org to learn more.

Vision

Through the EITC Coalition, we aim to provide free tax preparation services to more and more San Diegans each year, helping reduce the effects of poverty and create meaningful pathways to economic mobility. UWSD will continue to lead the Coalition, projecting the completion of over 500,000 returns between 2020 and 2030, helping to bring over $350 million back to low- to moderate-income residents. By broadening our network of local community partners, we continue to grow our reach and transform the lives of even more San Diegans.

Thank You to Our Partners

The Coalition leverages the collective power of partner organizations to get money back into the hands of San Diego County residents who need the support most.

![2020 COPAO Logo [PNG]](https://uwsd.org/wp-content/uploads/2025/03/2020-COPAO-Logo-PNG.png)

Make an Impact Today

Donate today to create a lasting impact on the lives of thousands of San Diegans throughout the county. Whether you choose to make a one-time contribution or become a monthly donor, your generosity drives our mission to close gaps in our community through economic mobility and education initiatives.