SparkPoint

Moving San Diegans Toward Financial Prosperity

Shaping Bright Financial Futures

SparkPoint is one of our newest economic mobility initiatives, and it involves working with individuals and families to meet their basic needs, increase their income, build their credit, increase their savings, and reduce their debt. Established by United Way Bay Area in 2009 and inspired by the Annie E. Casey Foundation, SparkPoint is a proven model for addressing economic inequities and fostering financial stability. In 2024, we launched SparkPoint locally, empowering families to make sustainable financial decisions and achieve long-term goals.

Through the program, financial coaches work one-on-one with clients to set goals, brainstorm strategies, and set realistic action plans to help them meet their milestones. SparkPoint uses a client-led, family-centered approach that values strengths, builds on personal motivation, and provides accountability to help clients achieve goals ranging from paying off a credit card to pursuing a degree or certification.

Many San Diegans are not earning enough money to cover their basic needs, and SparkPoint helps them get on a pathway toward economic mobility. As the lead of SparkPoint, United Way of San Diego County (UWSD) serves as the backbone for data and evaluation, project development, partnership management, outreach, funding, and advocacy.

Creating Pathways to Economic Mobility

SparkPoint is a model that works with low- and middle-income individuals and families long-term, looking at all aspects of their financial health, to achieve financial prosperity. SparkPoint partners work with clients on establishing and reaching goals such as earning an income that meets family needs, increasing credit scores to access good interest rates and banking products, building savings, reducing debt, and more. It is a collaboration of multiple nonprofits and financial entities that work together to seamlessly provide integrated services to assist families financially.

Family-Centered Financial Coaching

SparkPoint coaches utilize a family-centered coaching model. Coaches work with clients to identify the goals and needs of their entire families and to build strong community networks. It is a trauma-informed and equity-centered approach rooted in an understanding of the persistent effects of systemic inequities and poverty. SparkPoint is also a data-driven program that rigorously tracks client progress toward key financial goals through intensive one-on-one and group coaching.

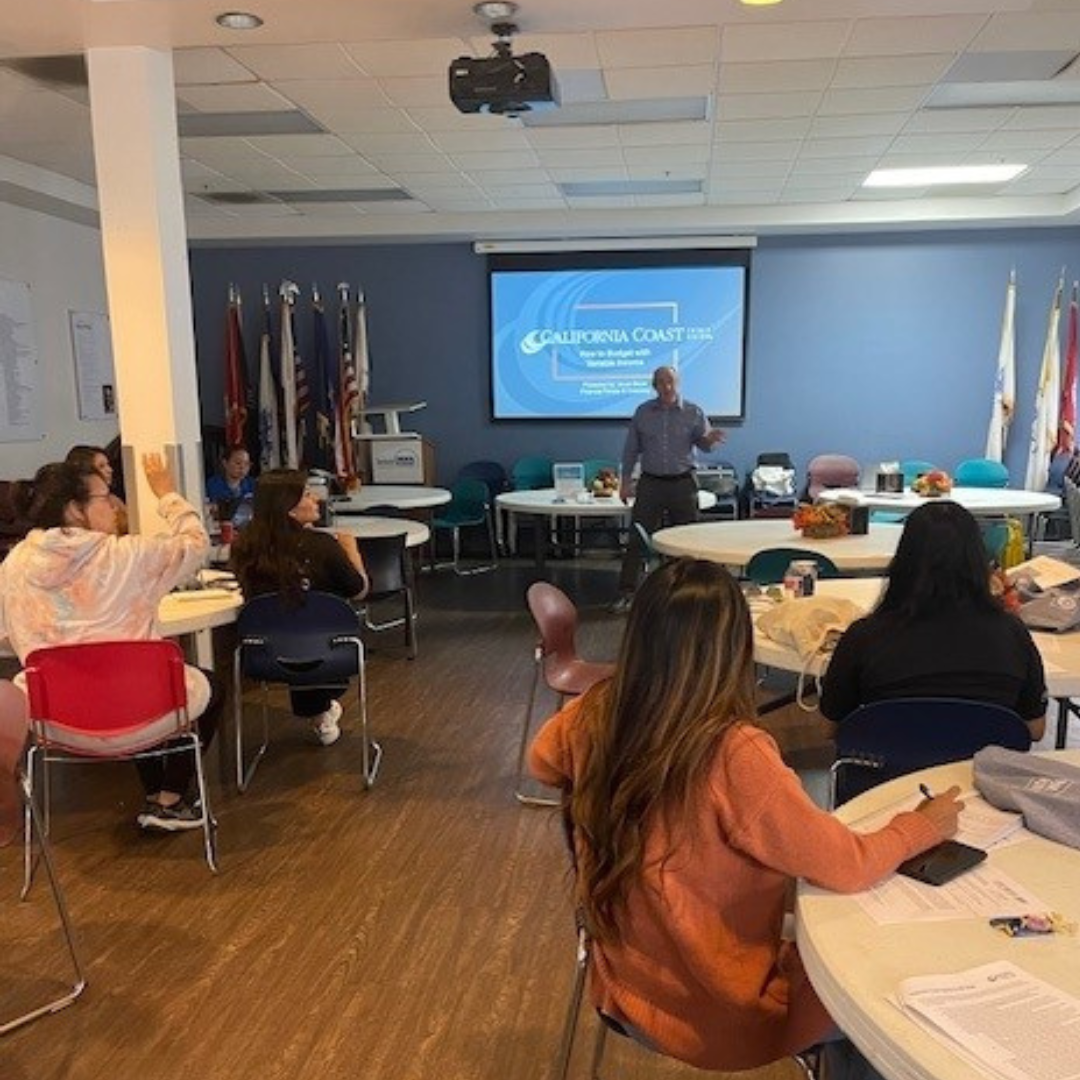

SparkPoint Money Management Workshops

SparkPoint hosts monthly Money Management Workshops at various community locations across San Diego County. These 1-2 hour group workshops focus on financial education and feature presentations by expert partners on topics like creating a spending plan, building credit, managing debt, and teaching kids about money. Additionally, participants gain access to valuable community resources.

Our Vision

Our vision for SparkPoint is to ensure that individuals and families across San Diego County have access to high-quality financial workshops and personalized 1:1 financial coaching through our trusted partners, empowering them to achieve the financial goals they set for themselves.

Thank You to Our Partners & Funders

Our valued partners—including banking institutions, community-based organizations (CBOs), and schools— are instrumental to the success of SparkPoint programs. Together, we bring essential financial coaching resources to historically underserved communities across the county, creating opportunities for residents to achieve their goals and climb the economic ladder toward lasting prosperity.

Our Partners

Our Funders